Buying Real Estate in Dubai with Crypto: The Ultimate Guide – All You Need to Know

Dubai is leading the way in crypto-powered real estate transactions, making it easier than ever to buy property using Bitcoin,…

Dubai is leading the way in crypto-powered real estate transactions, making it easier than ever to buy property using Bitcoin, Ethereum, and other digital assets. With crypto-friendly regulations, tax advantages, and a growing number of developers accepting digital currency, Dubai has become a hotspot for investors looking to turn their crypto wealth into prime real estate. This ultimate guide covers everything you need to know - from legal considerations to step-by-step instructions - ensuring a smooth and secure property purchase using cryptocurrency.

Cryptocurrencies have made their way into real estate transactions worldwide, with buyers now purchasing properties using Bitcoin and other digital currencies. This trend has been gaining substantial global traction in recent years, and nowhere is it more evident than in Dubai. Renowned for its futuristic vision and tech-driven initiatives, Dubai is emerging as a prime destination for crypto property purchases. Investors who accumulated wealth in crypto are attracted by Dubai’s innovation-friendly environment and the opportunity to invest in a thriving real estate market without cashing out into traditional currency. In this blog post, we explore how to buy real estate with cryptocurrency in Dubai – covering why it’s appealing, the legal framework, a step-by-step purchasing guide, risks to watch out for, and real examples of crypto property deals.

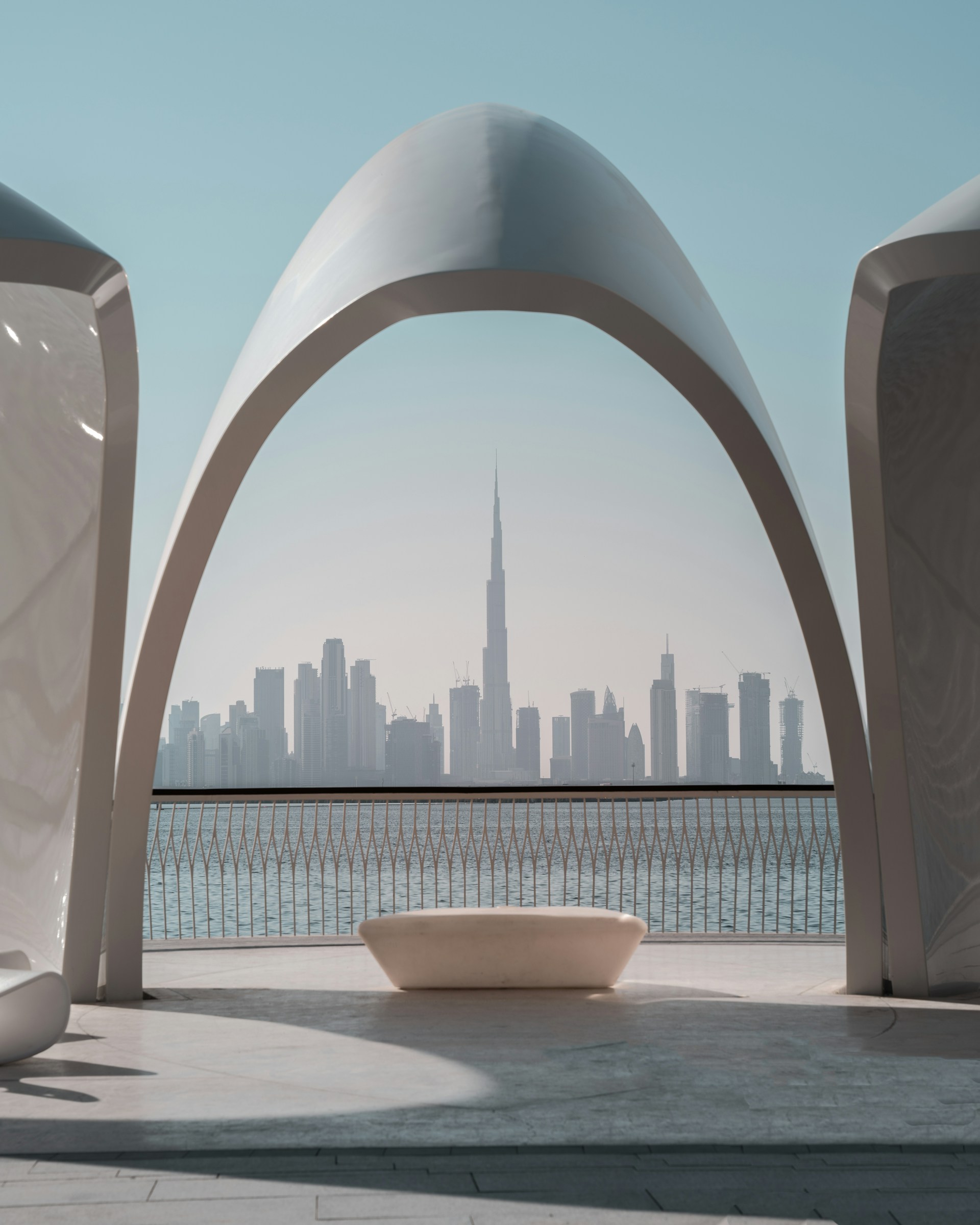

Dubai's skyline reflects the city's growth as a global hub for crypto and real estate innovation. As a major financial center known for innovation, Dubai has firmly positioned itself as a leader in integrating cryptocurrency into real estate. The city’s government has embraced blockchain technology and virtual assets, establishing dedicated regulatory bodies to oversee crypto activities. Combined with investor-friendly policies and a dynamic property sector, this makes Dubai one of the most crypto-friendly real estate markets in the world.

Dubai has introduced a robust regulatory framework that welcomes virtual assets. The emirate established the Dubai Virtual Assets Regulatory Authority (VARA) in 2022 to oversee crypto transactions and ensure compliance with laws. The UAE’s Securities and Commodities Authority (SCA) also provides guidance on virtual asset activities. This proactive government support gives buyers confidence that their cryptocurrency property transactions are recognized and protected under clear rules. In fact, Dubai’s Law No. 4 of 2022 on Virtual Assets created a legal framework for crypto payments in Dubai, solidifying the city’s status as a global leader in crypto adoption.

Another major draw is the UAE’s tax-friendly environment. There is no capital gains tax on personal cryptocurrency profits in the UAE, meaning investors can convert their crypto into property without losing a chunk to taxes. Crypto investors who have seen significant gains can reinvest in Dubai real estate and legally pay zero tax on those gains, which is a huge incentive. Additionally, the UAE imposes no annual property tax, making ongoing ownership costs lower. These advantages make buying property with crypto in Dubai a financially attractive option compared to jurisdictions with heavy taxes on crypto cash-outs or property holdings.

Dubai’s real estate sector has warmly embraced digital assets, making it feasible to purchase property directly with crypto. Several prominent developers in Dubai now accept cryptocurrency payments for property purchases. For example, luxury developer DAMAC Properties accepts Bitcoin and Ethereum as payment, and Emaar Properties(the company behind Burj Khalifa) has also begun to support crypto transactions for some of its high-end projects. Other developers like Nakheel, MAG Development, and Ellington have partnered with fintech and blockchain firms to facilitate crypto payments. This growing acceptance means buyers have an expanding selection of reputable companies willing to transact in crypto. Furthermore, Dubai’s reputation as a hub for crypto entrepreneurs and investors means there is a strong ecosystem supporting such transactions. The city’s openness to innovation and its large expatriate investor community have made it a hotspot for turning crypto wealth into tangible assets like real estate.

By investing crypto into Dubai property, buyers can also reap the lifestyle and financial perks of owning in this world-class city. Dubai real estate offers high rental yields (often 8-10% in desirable areas) and the potential for strong long-term appreciation. Significant real estate investment can even qualify foreign buyers for long-term residency visas (the “Golden Visa”), especially for investments over AED 2 million (~USD 545,000). This, combined with the ability to transact quickly and securely via cryptocurrency, makes Dubai incredibly appealing for forward-thinking investors looking to diversify their holdings into real estate.

Buying property with cryptocurrency in Dubai is legal, but it must be done in compliance with the UAE’s regulations and property laws. It’s important to understand the legal framework to ensure your crypto-funded real estate purchase is smooth and enforceable:

Regulatory Framework: The United Arab Emirates has established clear regulations for virtual assets. In Dubai, the Virtual Assets Regulatory Authority (VARA) oversees crypto activities, and the federal SCA provides oversight as well. VARA was created in March 2022 under Dubai’s Virtual Assets Law (Law No. 4 of 2022) to regulate and license crypto exchanges, brokers, and even crypto payments. This means that while crypto is not legal tender (the UAE dirham remains the official currency), it is recognized as a valid asset class for transactions under specified conditions. Property purchases using crypto are permitted as long as they adhere to these regulations.

Compliance with Property Laws: Real estate transactions in Dubai are governed by the Dubai Land Department (DLD) and other UAE property laws. When you buy a property – even with crypto – the transaction ultimately needs to be registered in dirhams (AED) with the DLD for the title transfer. In practice, this means the property price is typically denominated in AED on the sale contract, and any crypto payment will be converted to the equivalent AED value at the time of purchase. Some developers who accept crypto will price the property in AED but allow you to pay in cryptocurrency based on the AED-crypto exchange rate at that moment. The UAE Central Bank’s regulations often require that the crypto amount be converted into dirhams before finalizing the deal. Therefore, the role of licensed crypto-to-fiat conversion platforms is crucial – these intermediaries ensure the seller ultimately receives AED and that the deal is legally recognized. Developers or brokers might work with a regulated exchange or payment processor to facilitate this conversion seamlessly.

Licensed Crypto-to-Fiat Platforms: It’s highly recommended (and often required) to use a licensed exchange or OTC broker in the UAE to handle the conversion of cryptocurrency to fiat during a real estate transaction. For instance, platforms like Binance and BitOasis (both operating under local regulatory approvals) support AED transactions, enabling you to deposit your crypto and convert it to dirhams in a compliant manner. In some cases, the real estate developer’s escrow account will be set up through a licensed payment gateway that accepts your crypto, immediately converts it to AED, and deposits the funds to the seller. Using these authorized channels protects both buyer and seller – it ensures anti-money laundering (AML) laws are followed and that the transaction is transparent to authorities. A licensed financial intermediary will handle the exchange process if conversion to AED is needed, so the buyer doesn’t have to personally carry out large crypto-for-cash trades outside a regulated environment.

Anti-Money Laundering (AML) and KYC: As with any large transaction, buyers must comply with AML and Know-Your-Customer (KYC) requirements. Expect to provide documentation on the source of your crypto funds to the broker, developer, or exchange facilitating the deal. Authorities want to ensure that the funds used to buy property are not from illicit activities. Dubai’s regulators require transparency – you may need to show records of your crypto transactions or bank statements if you converted from fiat. Working with a licensed brokerage or exchange will usually involve completing their KYC process. Being prepared to disclose how you acquired your Bitcoin or Ethereum (for example, trading history or mining records) will help the transaction move forward without compliance issues. The good news is that the UAE does not impose any taxes on crypto holdings or transfers themselves, but if you are an international investor, you should consult with a tax advisor about any obligations in your home country.

Contract and Legal Counsel: Ensure all agreements are in writing and review the sale contracts carefully. The standard Sales and Purchase Agreement (SPA) will specify the property price in AED and outline that payment will be made via cryptocurrency equivalent. It’s wise to engage a Dubai-based real estate lawyer or conveyancer who is familiar with crypto transactions. They can make sure the SPA properly reflects the arrangement (including how the crypto will be converted and acknowledged) and that it protects you in case of any payment disputes or price volatility issues. Also, verify that the developer or seller has a clause about handling any extreme market movement (for example, if crypto value changes significantly before the payment is completed). A licensed notary might be involved to oversee the signing of documents, just as with any property sale.

In summary, buying property with crypto in Dubai is feasible under the current legal framework, but it must be done through regulated channels and with proper documentation. By following UAE regulations, using licensed exchanges for conversion, and having solid legal agreements, you can ensure your crypto-funded real estate purchase is secure and recognized by authorities.

Not all cryptocurrencies are treated equally in real estate transactions – typically only well-established coins are accepted by developers and agencies. Here are the most commonly accepted digital currencies for buying property in Dubai:

Bitcoin (BTC): The original cryptocurrency is widely accepted for property payments. Many developers, including DAMAC, have explicitly stated they accept Bitcoin. Its global recognition and liquidity make it a popular choice for large transactions like real estate.

Ethereum (ETH): Ethereum is usually the second-most accepted crypto for properties. Dubai’s real estate sellers often accept ETH alongside BTC, given Ethereum’s large market cap and strong infrastructure. Both BTC and ETH are favored because they are perceived as blue-chip crypto assets.

Stablecoins (USDT/USDC): Tether (USDT) – a stablecoin pegged to the US dollar – is increasingly common in real estate deals. Some brokers prefer stablecoins because their value is steady, eliminating the volatility risk during the payment process. USDT and other USD-pegged coins like USD Coin (USDC) offer the speed of crypto without price fluctuations. In fact, industry reports note a rise in using stablecoins for property transactions to reduce volatility concerns. If you hold significant value in crypto, converting it to a stablecoin for the purchase can protect both parties from sudden market moves while the deal is finalized.

Other Major Cryptos: Beyond BTC and ETH, some developers and intermediaries accept Ripple (XRP), Binance Coin (BNB), and other large-cap cryptocurrencies. For example, in an innovative 2020 partnership, a Dubai real estate agency worked with a crypto exchange to accept payments in Bitcoin, Ethereum, XRP, and even other major coins and tokens. The key is that the cryptocurrency should have sufficient liquidity and regulatory clarity. Niche altcoins are generally not used for property payments unless immediately converted to an accepted coin.

It’s important to check with the specific developer or real estate agent which cryptocurrencies they accept. Most will list the options (e.g., “We accept BTC, ETH, USDT” etc.). Also, even if a developer doesn’t take your particular cryptocurrency, you could convert it into a widely accepted coin or a stablecoin via an exchange prior to the purchase. Always plan the currency you intend to use and ensure the receiving party is on board with that choice.

Developers and Agencies Accepting Crypto: As mentioned, several leading real estate companies in Dubai support crypto transactions. DAMAC Properties was among the first, announcing in 2022 that it would accept Bitcoin and Ethereum for its luxury developments. Emaar Properties has enabled crypto payments for select projects, signaling mainstream acceptance. Nakheel, known for the Palm Jumeirah, and MAG Developers have also been crypto-forward, with MAG even exploring tokenization of real estate assets. On the agency side, some firms have made headlines by facilitating crypto deals by partnering with exchanges to accept multiple cryptocurrencies (BTC, ETH, XRP, and stablecoins) and convert them to AED for their clients. This kind of partnership ensures that even if a buyer pays in crypto, the seller gets the funds in dirhams, marrying convenience with compliance. As crypto adoption grows, an increasing number of brokers and developers in Dubai are likely to add crypto payment options to cater to the demand.

If you’re ready to invest in Dubai real estate using cryptocurrency, the process will be similar to a normal property purchase with a few extra steps to handle the digital currency aspect. Below is a step-by-step guide:

Choose the Right Property and Developer: Begin by selecting the property you want to buy, just as you would with any real estate investment. Research developers or sellers who are open to cryptocurrency payments – this could be advertised in their marketing or you can inquire through a real estate agent. Dubai offers everything from apartments and villas to commercial spaces that can be bought with crypto. Working with a crypto-friendly real estate agent or developer is key at this stage. They will guide you on available properties and explain their accepted payment forms. Make sure the property is eligible for sale to you (for example, foreigners can buy freehold properties in designated areas). Perform all the usual due diligence on the property’s location, price, and developer reputation.

Agree on Payment Terms in Crypto: Once you’ve identified the property and confirmed the seller is willing to accept cryptocurrency, you’ll need to negotiate the payment terms. Typically, the property price is set in the local currency (AED). The buyer and seller (or developer) will agree on how to translate that price into crypto for the payment. Often, the price in AED is fixed in the contract, and the equivalent crypto amount is calculated at the time of transaction based on a market exchange rate. For example, if a property costs AED 5,000,000, the contract will state that amount, and on the day of payment they might calculate how many BTC or ETH equals AED 5,000,000 at the current rate. It’s wise to discuss whether the rate will be determined at a specific source (like a particular exchange’s rate) and if there’s a cut-off time for the rate lock to avoid confusion. In some cases, buyers and sellers might agree to use a stablecoin such as USDT for the transaction to avoid last-minute volatility. Clarity at this stage is crucial: decide which cryptocurrency will be used, how the conversion is handled, and who pays any conversion fees. You may also need to agree on a deposit – sometimes a small amount is paid upfront (in fiat or crypto) to reserve the unit and signal commitment.

Select a Secure Crypto Payment Method: Before transferring any funds, set up the mechanism for payment. If the developer has a crypto payment gateway or an official wallet address, obtain those details. Ensure you will be sending the crypto to a verified wallet address provided by the legitimate party (double-check all characters of the wallet address to prevent any mistakes or phishing scams). If you’re using an exchange or OTC service to assist, coordinate with them on timing. For a peer-to-peer transfer, you’ll typically use your own digital wallet to send the agreed cryptocurrency amount to the seller’s or intermediary’s wallet. Security is paramount – use a secure internet connection and, if possible, conduct the transfer in person at the developer’s office or your lawyer’s office for additional assurance. At the moment of transfer, you will send the exact agreed amount of BTC, ETH, USDT, etc., to the provided address. Once you execute the transaction, the blockchain will record it and you can show the transaction ID as proof of payment.

Use an Intermediary or Exchange for Conversion (if required): Depending on the agreement, you may need to convert your crypto into AED as part of the closing process. Some developers handle crypto directly, but many will use a licensed intermediary to convert crypto to fiat on the spot. Crypto exchanges can step in to instantly convert the buyer’s crypto into dirhams for the seller. If you’re going this route, you might deposit your crypto into the exchange’s escrow, who will then transfer AED to the seller. Alternatively, you might accompany the seller to a crypto OTC broker who facilitates the swap. Ensure the intermediary is licensed and reputable to avoid any counterparty risk. They will provide a receipt or proof of conversion, which will be needed for the next step. The UAE’s stance is that the final settlement often has to be in AED, so using a regulated conversion service keeps everything compliant. From the buyer’s perspective, as long as you transfer the crypto to the intermediary as agreed, it’s their job to handle giving the seller the equivalent dirhams – but it’s good to stay involved until the seller confirms receipt of funds.

Signing Contracts and Finalizing Documentation: With payment arranged, both parties will sign the necessary contracts to officiate the sale. The main document is the Sale and Purchase Agreement (SPA), which should clearly state the purchase price, property details, and note that payment is made via cryptocurrency (or via a particular exchange service) for transparency. Make sure all buyer and seller details are correctly recorded, and attach any necessary addendums about the crypto payment method. At this stage, you will also submit required documents for the property transfer. These typically include your passport (and visa or Emirates ID if you have one), proof of address, and any other KYC documents the developer or Land Department might need. If you are not in the UAE, you might have a Power of Attorney represent you in signing – that document would also need to be prepared in advance. Once contracts are signed by both parties, you usually proceed to payment (or if you’ve paid the crypto already into escrow, the contract might be signed after confirming the funds are secured). It’s prudent to have a lawyer or legal advisor review all documents before you sign, especially since crypto transactions in real estate are relatively new – you want to ensure the contract covers all scenarios (like what happens if a refund is needed, which currency would be refunded, etc.).

Ownership Transfer and Registration: After payment is confirmed (either the seller sees the crypto in their wallet or, more commonly, the seller receives the AED after conversion), the property title can be transferred. Both buyer and seller (or their representatives) will go to the Dubai Land Department (or use the DLD’s online system) to officially transfer the ownership. The DLD will likely require proof that the purchase amount was settled – documentation from the intermediary or a payment receipt will be provided to show the funds were received. You will need to pay the standard DLD transfer fees (4% of property price, typically) and any applicable trustee office fees, usually in AED. Once all formalities are done, the DLD will issue a new Title Deed in your name. Congratulations – you now own the property, and you achieved it using cryptocurrency! Make sure to collect all final paperwork, including the new title deed, and receipts for any fees paid. At this point, the transaction is completed and recorded just like any other property sale in Dubai’s registry.

Throughout this process, constant communication with the developer/agent and possibly a crypto-savvy legal advisor is important. Each transaction might have slight variations in procedure, but these steps cover the core journey from selecting a property to getting the keys – using crypto as the medium of exchange.

While buying property with cryptocurrency in Dubai is an exciting and innovative approach, it does come with certain risks. Prospective buyers should be aware of these risks and take precautions to ensure a safe transaction:

Volatility Risk: Cryptocurrency prices can be highly volatile. The value of Bitcoin or Ethereum can swing significantly in a matter of days or even hours. This poses a risk in real estate deals – if the crypto price drops sharply before you make the payment, you might end up paying a higher effective price (in fiat terms) for the property than expected. Conversely, if prices spike, the seller might worry about receiving less fiat value. To mitigate this, it’s common to lock in the crypto-to-AED exchange rate at the time of agreement or use a stablecoin for the transaction. As a buyer, you might consider converting your crypto to a stablecoin like USDT shortly before the purchase, which ensures you know exactly how much fiat value you’re transferring. Always clarify the exchange rate methodology in the contract, and try to execute the payment quickly once terms are set to avoid market moves. Some intermediaries offer escrow services that will guarantee the conversion rate for a short window to eliminate this uncertainty.

Fraud and Scams: Wherever large sums of money are involved, fraud is a concern. Cryptocurrency transfers are irreversible – if you accidentally send funds to the wrong wallet or to a fraudulent party, it can be extremely difficult to recover them.

Preventative measures are crucial: Only deal with well-known developers or licensed real estate brokers when arranging a crypto deal. Be cautious of any “too good to be true” offers from unknown sellers asking for direct crypto payment. Always independently verify wallet addresses (confirm verbally or via official correspondence) before sending any coins. It’s also wise to conduct the transaction in a face-to-face setting at the developer’s sales office or via an official payment portal, rather than sending crypto to an individual’s wallet with just an email confirmation. In Dubai, developers that accept crypto will usually have a formal process – utilize that, and avoid side deals. Using a trusted third-party escrow or exchange can add a layer of security, as they often double-check the details and can hold funds until all parties approve.

Regulatory Changes: The crypto regulatory landscape is evolving. While Dubai currently supports virtual asset transactions, future regulations could introduce new requirements or oversight. This is more of a long-term consideration; for instance, down the line there could be reporting requirements for property bought with crypto, or specific licenses needed for brokers. Staying informed about UAE’s crypto regulations (through VARA updates, etc.) is important. As of now, ensure the transaction complies with all current laws – use licensed exchanges and follow VARA guidelines – so that even if rules tighten later, your transaction was done by the book and is not in jeopardy. Also, remember that cryptocurrency is not legal tender – if a dispute arose, a court might consider the AED value documented in the contract. Make sure that aspect is clear in paperwork to avoid any legal ambiguities.

Liquidity and Conversion Delays: In some cases, converting a very large amount of cryptocurrency to dirhams might face liquidity constraints or slight delays. If you’re moving millions of dollars worth of crypto, an exchange might need a bit of time to process that volume or might move the price slightly in the market during conversion. Plan for this by engaging the exchange ahead of time – inform them of the anticipated transaction so liquidity can be prepared. Breaking the transfer into smaller tranches is another strategy, though that can introduce its own complexities. The key precaution is to choose an exchange or OTC desk with high liquidity and a good track record in handling large transactions. Dubai has several such providers (some even specialize in real estate conversions). By using these, you reduce the risk of any hiccup in converting and transferring funds at the crucial moment.

Technical Wallet Security: Ensure that your crypto is stored securely up until the moment of transfer. If your digital wallet were compromised, you could lose the funds needed for the property purchase. Use hardware wallets or secure wallet apps with two-factor authentication. It might be wise to transfer your needed amount of crypto to a brand new wallet address that you control shortly before the transaction, minimizing exposure. Also, double-check that you are sending on the correct network (for example, sending USDT on the Ethereum network to an Ethereum-compatible address, if that’s what the seller expects). A small mistake in network or address can result in lost funds. Taking the time to verify details and perhaps doing a small test transaction (like sending a tiny fraction first to confirm receipt) can provide peace of mind for large transfers.

Working with Reputable Professionals: One of the best precautions is to partner with professionals experienced in crypto real estate deals. A real estate agent or broker who has handled crypto transactions can guide you through the process and help avoid pitfalls. Likewise, using a law firm that is knowledgeable about both property law and cryptocurrency can protect your interests. Reputable developers will often have a designated person or department for handling crypto payments – don’t hesitate to ask them detailed questions about how they manage it. If anything feels unsure, bring in an expert consultant. The cost of professional advice is minor compared to the property value, and it adds an extra layer of safety to your investment.

By anticipating these risks and taking appropriate steps, you can greatly reduce the chance of any problems. Buying property with crypto in Dubai can be as safe and straightforward as a normal transaction, provided you follow best practices and remain vigilant throughout the process.

Real-world examples of cryptocurrency being used in Dubai real estate illustrate how this trend has moved from novelty to reality:

Early Adoption – Aston Plaza (2017-2018): One of the first major crypto real estate initiatives in Dubai was the Aston Plaza & Residences project announced in 2017. This development, launched by British entrepreneurs Michelle Mone and Doug Barrowman, offered units for sale in Bitcoin. By early 2018, reports indicated that 50 luxury apartments in Dubai were sold entirely for Bitcoin, marking the first real estate transactions in the UAE completed via cryptocurrency. Buyers from the early crypto community – many of them young tech-savvy investors – jumped on the opportunity to trade their Bitcoin for physical property. This case proved that there was genuine demand for crypto-denominated real estate deals and put Dubai on the map as a place willing to innovate in property sales. (It’s worth noting that this particular project faced delays later, but the sales that did occur demonstrated the concept’s viability at the time.)

Major Developers Embrace Crypto (2021-2023): Fast-forward a few years, and some of Dubai’s largest developers began officially embracing cryptocurrency. In 2022, DAMAC Properties – a leading developer known for luxury projects – announced it would accept Bitcoin and Ethereum as payment. By mid-2022, DAMAC reported it had already completed about $50 million worth of property transactions via crypto since the start of that year. This is a significant volume, highlighting that many investors took advantage of the option to buy DAMAC villas and apartments with digital currency. Around the same time, Emaar Properties (developer of the Dubai Mall and Burj Khalifa) also started facilitating crypto payments for property, a move that was heralded on social media as a sign of mass adoption. These examples show that crypto deals are not just fringe cases – they are happening at the heart of Dubai’s property market. The developers typically partner with payment processors to handle the technical side, but from the buyer’s perspective it feels like a seamless part of the purchase process.

Brokerage and Exchange Partnerships: Dubai’s real estate agencies have also been key players in enabling crypto transactions. Some brokerages, partnered with the crypto exchanges to simplify property purchases with crypto. Through this kind of partnerships, investors can pay for properties using Bitcoin, Ethereum, XRP, and other major coins, while the exchange handles converting the crypto to fiat and ensuring the transaction complied with regulations. This kind of arrangements provide more liquidity and stability to the market – buyers have more payment choices, and sellers are comfortable knowing they’d receive AED. Such collaborations set a template for how real estate companies can work with crypto firms to bridge the gap between digital assets and physical assets. It also underscores the importance of licensed intermediaries: Exchanges can be licensed in the Dubai Multi Commodities Centre (DMCC) free zone, which adds credibility to the process. The success of deals done through Real Estate Agencies and Exchanges encourages other agencies and developers to follow suit.

International Investors Using Crypto: Dubai’s property market has seen interest from international crypto investors as well. There have been reports of investors from regions like Europe, East Asia, and India using cryptocurrency gains to buy Dubai real estate as a way to diversify assets and relocate funds. For instance, some tech entrepreneurs and crypto fund holders purchased luxury penthouses in Downtown Dubai and Dubai Marina using Bitcoin profits, drawn by the UAE’s 0% tax environment and the prospect of obtaining residency. In one case, an investor converted a substantial amount of cryptocurrency to purchase multiple units in a new development, leveraging a payment plan denominated in stablecoins to manage volatility. These anecdotes, some of which come through real estate consultancies and news features, demonstrate that the crypto-to-property route is attractive to those who might have difficulty moving large sums through traditional banking (due to capital controls in their home country, for example) or who simply want the convenience of paying directly from their digital wallets.

Each of these examples reinforces a common theme: Dubai is at the forefront of integrating cryptocurrency with real estate. What was once considered experimental – buying a house with Bitcoin – has become sufficiently mainstream in Dubai that both big-name developers and established brokers have done multiple such transactions. As time goes on, we’re likely to see even more case studies, perhaps involving new developments where a significant percentage of buyers choose to pay in crypto, or blockchain platforms that tokenize property ownership in Dubai. For now, the examples above provide a blueprint for interested buyers: they show that with the right partners and setup, a crypto property purchase in Dubai can be successfully executed.

Buying real estate with cryptocurrency in Dubai is an exciting convergence of modern finance and property investment. Dubai’s proactive embrace of crypto, combined with its lucrative real estate market, offers a unique opportunity for investors who want to leverage their digital assets. However, it’s essential to approach such transactions with informed caution. Below are some final tips and best practices for a successful experience:

Do Your Homework: Research the developer or seller’s reputation and experience with crypto transactions. Opt for projects by developers who have a clear process for accepting crypto or brokers who can show they’ve done it before. Likewise, understand the property market – crypto or not, fundamentals like location, quality, and market price still matter for your investment’s long-term value.

Engage Experts: Consider hiring professionals to guide you. A real estate agent experienced in crypto deals can navigate negotiations and paperwork effectively. Legal counsel is crucial to review contracts and ensure the crypto payment is properly documented. If you’re using an exchange for conversion, get a dedicated account manager if possible to oversee your large transaction. Expert guidance can prevent costly mistakes in an unfamiliar process.

Plan the Payment Logistics: Decide in advance which cryptocurrency you will use and have a strategy for handling volatility. If using Bitcoin or Ethereum, be ready to transfer when needed and watch the market closely near the payment date. If volatility worries you, convert your funds to a stablecoin like USDT ahead of time. Communicate with the receiving party on how to handle any price fluctuation – sometimes a rate freeze for a few hours can be arranged on the transfer day. Also, ensure you have any necessary wallet setup completed and tested.

Use Licensed Platforms: When converting crypto to fiat (or vice versa), use only licensed exchanges or OTC brokers in the UAE. These entities operate under UAE financial regulations, which means your transaction will be compliant and reported as required. Avoid peer-to-peer cash deals or unlicensed “money exchangers” for large sums, as those could put you at legal risk or expose you to fraud. The likes of BitOasis, Binance (in collaboration with local entities), or other UAE-approved crypto platforms should be your go-to for handling funds.

Ensure Clear Documentation: Insist that the sale contract explicitly mentions the use of cryptocurrency for payment and the agreed conversion method. This way, there is a written record in case any disputes arise later about whether payment was made correctly. After the transaction, keep copies of all relevant documents: the SPA, proof of crypto transfer (transaction hash from the blockchain), any conversion receipts from the intermediary, and the new title deed. Having a paper trail (or digital trail) of the entire process is important for your records and peace of mind.

Stay Within Legal Boundaries: Adhere to all legal requirements such as registering the property transfer with the Dubai Land Department and paying the required fees in AED. Just because the purchase involves crypto doesn’t exempt you from the standard procedures of property ownership. Also, if you’re moving funds from abroad, ensure you comply with any declarations needed (for instance, when bringing large sums into the UAE, even as crypto, make sure it’s transparent). Being upfront and compliant will save you from regulatory troubles down the road.

Think Long Term: Consider your exit strategy as well. If you buy property with crypto now, when you sell that property in the future, the buyer might pay in AED or another currency. Plan for how you would potentially convert the proceeds back to crypto or to fiat and any tax implications that might have in your home jurisdiction. Dubai might not tax you, but if you eventually repatriate money, know the rules so you can optimize accordingly.

In conclusion, Dubai offers one of the most welcoming environments to turn cryptocurrency holdings into tangible real estate assets. The process is becoming more streamlined as developers, exchanges, and regulators work hand-in-hand to facilitate these transactions. By understanding the legal landscape, partnering with reputable parties, and taking sensible precautions, clients can confidently navigate buying property with crypto. As with any investment, balancing enthusiasm with due diligence is key. With the right approach, you can join the growing number of savvy investors who have successfully purchased Dubai real estate using cryptocurrency – unlocking the benefits of both the digital economy and the vibrant Dubai property market.

If you're looking to buy property in Dubai with cryptocurrency, exchange crypto to fiat in Dubai, or purchase crypto abroad, Bonema can assist you. With expertise in real estate and digital asset transactions, Bonema provides secure and efficient solutions for investors navigating Dubai’s crypto property market. Whether you need help finding a crypto-friendly property, converting your digital assets, or ensuring your transaction is fully compliant, our team is here to guide you every step of the way.

Contact Bonema today to make your crypto real estate investment in Dubai seamless, secure, and hassle-free.

Don’t miss out on the opportunity to grow your wealth in one of the world’s most vibrant markets.

Contact us today to schedule your free consultation or reserve a spot on our next Dubai investment tour. Join like-minded investors and take the first step toward a prosperous future.

Looking for more insights and stories? Don’t miss out on these related posts. Explore more content to stay informed and inspired!

Dubai is leading the way in crypto-powered real estate transactions, making it easier than ever to buy property using Bitcoin,…

Dubai’s real estate market is a powerhouse of investment potential, attracting foreign investors from around the world with its high…

Dubai, a city of limitless possibilities, continues to defy global economic trends, offering unmatched opportunities for real estate investors in…

Dubai's tax landscape is as dynamic as the city itself, offering both opportunities and challenges for businesses and individuals looking…

Dubai's real estate market offers unmatched opportunities, whether you're looking to invest in off-plan properties or secure a ready home.…

Understanding the language of real estate is crucial when navigating Dubai's dynamic property market. Whether you’re an investor, buyer, or…

Dubai isn’t just a city of luxury—it’s a thriving global business hub where innovation meets opportunity. Entrepreneurs from around the…

Dubai's real estate market is a story of unparalleled growth, resilience, and reinvention. From desert sands to iconic skyscrapers, the…

Dubai, a city that defies expectations, continues its rise to global prominence, securing the sixth spot in the "2024 World’s…

Dubai is a city where the future meets tradition, known for pushing boundaries and redefining what’s possible. While it dazzles…

Looking for more insights and stories? Don’t miss out on these related posts. Explore more content to stay informed and inspired!

Dubai is leading the way in crypto-powered real estate transactions, making it easier than ever to buy property using Bitcoin,…

Dubai’s real estate market is a powerhouse of investment potential, attracting foreign investors from around the world with its high…

Dubai, a city of limitless possibilities, continues to defy global economic trends, offering unmatched opportunities for real estate investors in…

Dubai's tax landscape is as dynamic as the city itself, offering both opportunities and challenges for businesses and individuals looking…

Dubai's real estate market offers unmatched opportunities, whether you're looking to invest in off-plan properties or secure a ready home.…

Understanding the language of real estate is crucial when navigating Dubai's dynamic property market. Whether you’re an investor, buyer, or…

Dubai isn’t just a city of luxury—it’s a thriving global business hub where innovation meets opportunity. Entrepreneurs from around the…

Dubai's real estate market is a story of unparalleled growth, resilience, and reinvention. From desert sands to iconic skyscrapers, the…

Dubai, a city that defies expectations, continues its rise to global prominence, securing the sixth spot in the "2024 World’s…

Dubai is a city where the future meets tradition, known for pushing boundaries and redefining what’s possible. While it dazzles…

Your Trusted Strategic Partner for Tailored Investment Experiences, Knowledge and Resources in Dubai, UAE.

Error: Contact form not found.

© BONEMA – FZCO. All Rights Reserved.